Article updated on 29.05.2024

Money transfers are one of the most common services people and businesses use. Still, we all sometimes have the need to send money overseas – to friends, partners, contractors, etc.

But what is the best way to send funds to another country using your bank account? Well, there are many options, and today, we will cover the most popular ones! Read on to find out more in this Genome article.

How do international money transfers work?

International money transfers are transfers that are made between people or businesses located in different countries.

For instance, Bob works in Paris and needs to send funds to family abroad — to Barcelona, for example. This is considered an international transfer.

There are two ways to transfer money to another country: directly through your banking provider or using services like Western Union, where you can go to the company’s branch and send cash abroad.

Factors to consider when sending money abroad

When partnering with a bank or PSP for this specific feature, here are the factors you need to consider in the first place:

Transfer destinations. Check which countries a financial provider allows funds to be sent to.

Payment options and their speed. Nowadays, financial institutions usually offer multiple options for sending money to beneficiaries. Find out what these options are and how long they take.

Take note of foreign exchange services. A foreign exchange rate can significantly impact the amount the recipient receives. Compare the exchange fees and select the favorable exchange rate option.

Will your payments be secure? Lastly, the payment service provider must abide by major regulations (PCI DSS, PSD2, GDPR) and have anti-fraud systems.

How to send money internationally: a step-by-step guide

Let’s examine how to make a transfer to another country using Genome as an example. We have two options: SEPA and international transfers – SWIFT and other transfer systems.

SEPA transfer is a convenient option for payments within the European Union, while SWIFT can be used for payments in a foreign currency (other than EUR). Learn how to send money internationally with Genome below.

1. Setting up your transfer account

To make a SEPA payment, you can start a personal or business wallet inside Genome. The onboarding takes place completely online, with minimal documents required.

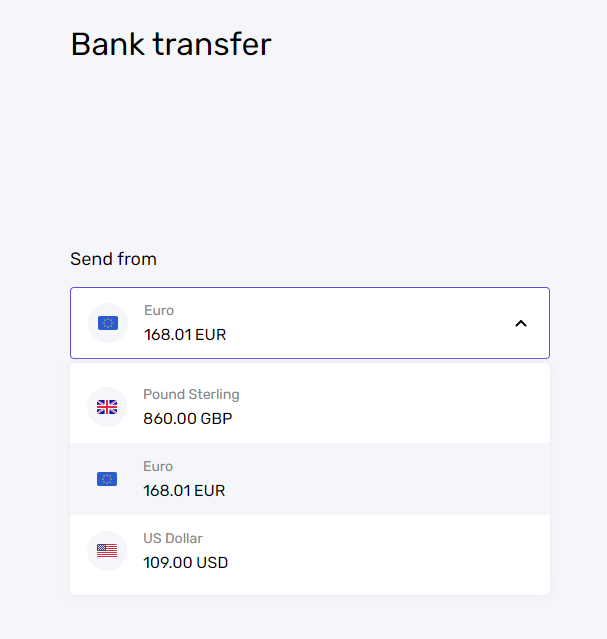

International transfers using SWIFT are currently available only for business wallet users. Once you open the account, you must receive the account number to make SWIFT transfers. Go to the Transfers tab and select the bank transfer option to make a transfer.

2. Selecting the amount and currency

Enter the amount you want to send to a beneficiary and choose a payment currency. SEPA transfers can only be made in euros. For SWIFT, 3 major currencies are available: euros, US dollars, and British pounds.

3. Entering recipient details

To make a SEPA payment, you need to enter the following details:

Beneficiary’s name;

Beneficiary’s International Bank Account Number (IBAN);

Beneficiary’s SWIFT code/Bank Identifier Code (BIC);

Payment description.

To make an international SWIFT transfer, you need to enter the following details:

Beneficiary’s name;

Recipient bank account number/IBAN;

Recipient bank SWIFT code (BIC) or Sort code;

Recipient’s bank account country;

Payment description.

4. Confirming and sending your transfer

Check if all the information you entered is correct, and send your payment.

5. Tracking the transfer

You can track your transfer in your wallet – via both web and app versions. By the way, Genome’s free transfers between Genome users can also be sent between different countries.

International transfers are not the only feature you can unlock inside Genome! You can also order a physical or virtual Visa debit card to pay online and in-store. Moreover, all our cards are contactless and compatible with Google Pay, Apple Pay, and Garmin Pay!

Open an account

in Genome online

Best ways to send money internationally

There are different methods to transfer funds to other countries. The main ones are bank transfers, mobile apps, and online services, including cryptocurrencies.

Let’s go over them one by one. We will be discussing bank transfers, mobile apps, and overview online services, including cryptocurrencies.

Bank transfer vs. online payment services

Many clients around the world still use traditional bank transfers. However, with digital services taking over multiple industries, it is no wonder more and more people are switching to online banking and mobile apps to transfer money overseas.

Since traditional banks have been around for a long time, you need to understand that these 2 types of providers are not mutually exclusive and have different benefits.

Fees. Good old banks have slightly (sometimes significantly) higher fees compared to online banking solutions.

Services. Financial giants are built to be somewhat safehouses for money and provide basic but time-tested financial solutions. Online payment providers, in contrast, are much more innovative and open to changes. Not to mention that no big bank will build their business based on transfers alone.

Speed. Online payment services are designed for speed and convenience. Some of them even provide almost instant payments. Traditional banks are slightly safer in this case, but this has a price of longer processing times.

Usability. To make a money transfer via traditional banks, you often need to visit a bank branch. Even if a bank allows online payments, you will need a digital signature to confirm your payment.

At the same time, online payment providers highly prioritize user-friendly experiences and allow clients to make transfers quickly and easily from their computers or mobile devices.

Mobile payment apps

Mobile payment apps are not as mainstream and usually serve one purpose: quick, personal money transfers. These apps allow users to send funds directly from their smartphones, making the process seamless and accessible from anywhere.

Currently, the most popular apps are:

Venmo. Primarily used in the U.S., Venmo offers an interesting idea: social media payments. The app allows users to share and comment on transactions. While its international use is limited, it is popular for domestic payments.

Cash App. An app that is known for its simplicity and ease of use, Cash App allows users to send and receive money instantly. It also supports Bitcoin transactions. At some point Cash App surpassed Venmo in total downloads, becoming one of the most popular peer-to-peer payment platforms.

PayPal. Needs no introduction – one of the most recognized names in online payments, PayPal’s mobile app offers various international payment features. It supports multiple currencies and has a large global network.

Wise. Known for its transparency and low fees, Wise provides exchange rates without hidden charges. Its app makes sending money straightforward and quick, making it a favorite for international transfers.

Cryptocurrency in international money transfers

Cryptocurrency is a viable and unique alternative for sending money internationally.

Let’s talk about the benefits of using it.

Speed. Cryptocurrency transactions can be completed in minutes, regardless of the sender’s and recipient’s locations.

Low fees. Cryptocurrencies often have lower transaction fees than banks, especially for large sums. This makes them cost-effective for international transfers.

Accessibility. Cryptocurrencies can be sent and received by anyone with internet access, making them accessible in regions with limited banking infrastructure.

Transparency and security. Blockchain technology, which underpins cryptocurrencies, provides a layer of security – each transaction is recorded on a public ledger.

On the other side, we have cons:

Volatility. Bitcoin, for example, costs nearly $70k (as of 23.05.2024) but a few weeks earlier, it was $58k. Such price changes may be good for investing, but they are unstable for a money transfer.

Regulation. Not every country recognizes cryptocurrencies as legal. Some nations have stringent regulations or outright ban cryptocurrencies, complicating their use for international transfers.

Adoption. While the number of cryptocurrency options is growing, their adoption is not yet universal. The sender and recipient must have access to cryptocurrency wallets and a basic understanding of using them.

Irreversibility. Cryptocurrency transactions are irreversible, as you don’t have a bank backing them up, and you can’t request a chargeback.

Exchange rates and fees across different platforms

Cryptocurrencies. Transaction fees are generally lower. There are no exchange rate markups, but conversion fees to and from fiat currencies can apply.

An exchange rate usually depends on market volatility. You can face a situation when, one day, your crypto deposit for a transfer disappears due to crypto market pricing. For example, the average Bitcoin fee from April to May 2024 has changed from $128 to $3.

Traditional banks. Banks often charge high fees for international transfers, including a flat fee plus a percentage of the transfer amount. Take, for example, Deutsche Bank. If a sender pays all fees, the total cost will look like this: €15 + €1.55 SWIFT fee + €25 flat fee for third-party expenses. Online providers usually have lower fees, but more on that later.

Online payment services. PayPal charges 2,9% of the transfer amount plus a fixed fee based on the destination country. PayPal uses a markup on exchange rates between 3 and 4 percent. Wise prides itself on using the real mid-market exchange rate without markups but with fixed fees.

Open an account

in Genome online

Mobile banking. This time, let’s take the Cash App as an example. There are no fees for sending money if you stick to standard transfers that are processed within 1-3 business days. For instant payments, the fees range between 0,5%-1,75%. Transfers supported by credit cards will also cost you 3% per transaction.

Exchange rate: Because Cash App mostly operates in the US, we can use another company for comparison, let it be N26. German-based N26 has no fee for bank account holders – their clients can make unlimited free card payments abroad. Their app provides an opportunity to enable or disable international payments, make online transactions, and make contactless payments.

Choosing the right service for your international money transfer needs

Your choice of money transfer option will depend on many factors, including:

Which transfer system your financial provider offers (SEPA, SWIFT, wire transfer, bank transfer, etc.);

Which countries do you plan to send money online to (SEPA or TARGET2 will be more suitable for the EU, while SWIFT is more intercontinental);

How much money do you need to send, and in which currency;

How fast do you need the funds to reach the beneficiary – some providers offer instant transfer options.

Other popular services for sending money abroad

Service | Key features | Fees | Exchange rate | User experience |

Wise | The service has transparent pricing and uses mid-market exchange rates. | Low, transparent fees based on the transfer amount and destination. | Real exchange rates with no hidden markup. | The website and app are easy to use, with clear cost breakdowns and payment tracking. |

PayPal/Xoom | The service makes domestic and international transfers available and offers different delivery options (bank deposit, cash pickup, etc.). | The fees are actually higher compared to other companies, especially when it comes to international transfers. | Marked up from the mid-market rate, which can reduce the amount the recipient gets. | Widely trusted, with easy-to-use interfaces and a robust customer support system. |

Western Union | Western Union has a network around the globe with options for cash pickups, mobile wallets, and bank transfers. | The fees can be high, especially for cash pickups and fast transfers. The costs vary depending on the country. | Often include a markup, which can reduce the received amount. | Overall, Western Union has an extensive reach, but its interface can be less modern compared to digital-native services. |

WorldRemit | The service offers a lot of options, such as bank deposits, mobile money, and cash pickups. | Generally competitive, with clear fee structures displayed upfront. | Better than traditional banks, but with a slight markup. | Simple and intuitive, with excellent mobile app functionality and transfer tracking. |

Xe | Xe specializes in foreign exchange and international transfers. | Often low, with some fee-free options depending on the currency pair. | Competitive, with rates better than many traditional banks. | Focused on foreign exchange, with a user-friendly platform and detailed rate information. |

Genome | Provides various financial services for businesses and individuals, including money transfers. | Has transparent pricing, with all fees listed openly on the website. | The exchange rates are shown when you transfer money abroad or domestically. | Clients can select the best way to send money internationally – using SEPA or SWIFT transfers. |

Tips for getting the best deal on your international money transfer

Transfers come in all shapes and sizes, but that’s not all. There are tricks you can use to make them more favorable and effective. Here’s how you can do it:

Keep an eye on the exchange rate. For transfers abroad, this can be one of the most crucial metrics. Use comparison tools to check exchange rates and fees across different services. Additionally, double-check the pricing – there may be some hidden fees for your bank account.

Get a multi-currency bank account. To avoid foreign exchange, you can get multi-currency accounts to keep funds in different currencies. This way, you can use a foreign currency to send and receive payments.

Timing is everything. If your payment is not time-sensitive, you can track exchange rates as they fluctuate and make a payment at the most favorable time.

Know your transfer systems. You can save funds just by selecting the most suitable payment systems. For instance, if you’re located in Germany and looking for a way to send money to Italy, it would be much more logical to do so via SEPA (and save funds) than using SWIFT.

Safety precautions when transferring money internationally

A lot of financial information is being entered during transfer operations. Thus, using a reliable service that follows electronic money regulations for transferring money is not always enough. No matter which payment method you use, during the operation, you should:

Always use strong and unique passwords for all your accounts and devices;

Switch on the multi-factor authentication in all apps/devices where possible;

Regularly update your software and use anti-virus programs;

Use only protected networks, avoid public Wi-Fi;

Check your accounts and balance at least once a day to quickly weed out any suspicious transactions;

Key takeaways

Selecting a way to send funds abroad depends on a plethora of factors. One thing can be said for sure: doing extensive research on which option will be the best for you before transferring money on a regular basis can save you time and money!

Open an account

in Genome online

FAQs

Can I send money internationally without a bank account?

Yes, you can send funds to another country without a bank account. You can use the services of one of the companies we listed in the article, like Western Union, where you can transfer cash.

What are the tax implications of sending large amounts of money abroad?

Sending large amounts of money can trigger tax implications, including gift taxes in the sender’s country and potential reporting requirements. Both the sender and the beneficiary may need to report the transaction to tax authorities. Seek professional advice for specific guidance based on your situation and jurisdiction.

How can I track my international money transfers in Genome?

You can track your international transfers in Genome directly inside your wallet – via both web and app versions. Check this article for more information.

Are there limits to how much money I can send abroad?

Usually, banks, correspondent banks, and other financial institutions set their own limits on how much money you can send.

What should I do if my international money transfer doesn’t arrive?

If your international transfer doesn’t arrive, you need to contact the payer so that they can clarify when the payment was made. Additionally, the payer can contact their financial institution for more details.