mass transfers

How to's

What is a mass transfer, and how to make one?

Please note that Genome’s merchant services have been temporarily unavailable since September 2024. When you run a company, there’s a big chance that sometimes you will need to make multiple payments simultaneously. It may seem overwhelming, but the truth is that the banking industry has taken care of that. We are talking about mass payment solutions – tools that allow you to easily instruct transfers in bulk. But how do mass payouts work exactly? Let’s uncover it all in this Genome article. Mass transfer meaning When discussing mass transfer, we usually assume this means the simultaneous sending of multiple payments

Business services

Business transactions and your company: overview

In 2021, the number of non-cash payments amounted to 114.2 billion in the euro area alone. Needless to say, our daily lives are full of transactions. So, an important question arises: are you sure you understand the difference between a personal and a business transaction? Today, Genome’s team is here to sway away all the doubts you may have about what business transactions are. Definition of a business transaction Generally, a business transaction is a broad term representing a process during which two or more parties exchange money, products, or services. The common denominator with all these transactions is that

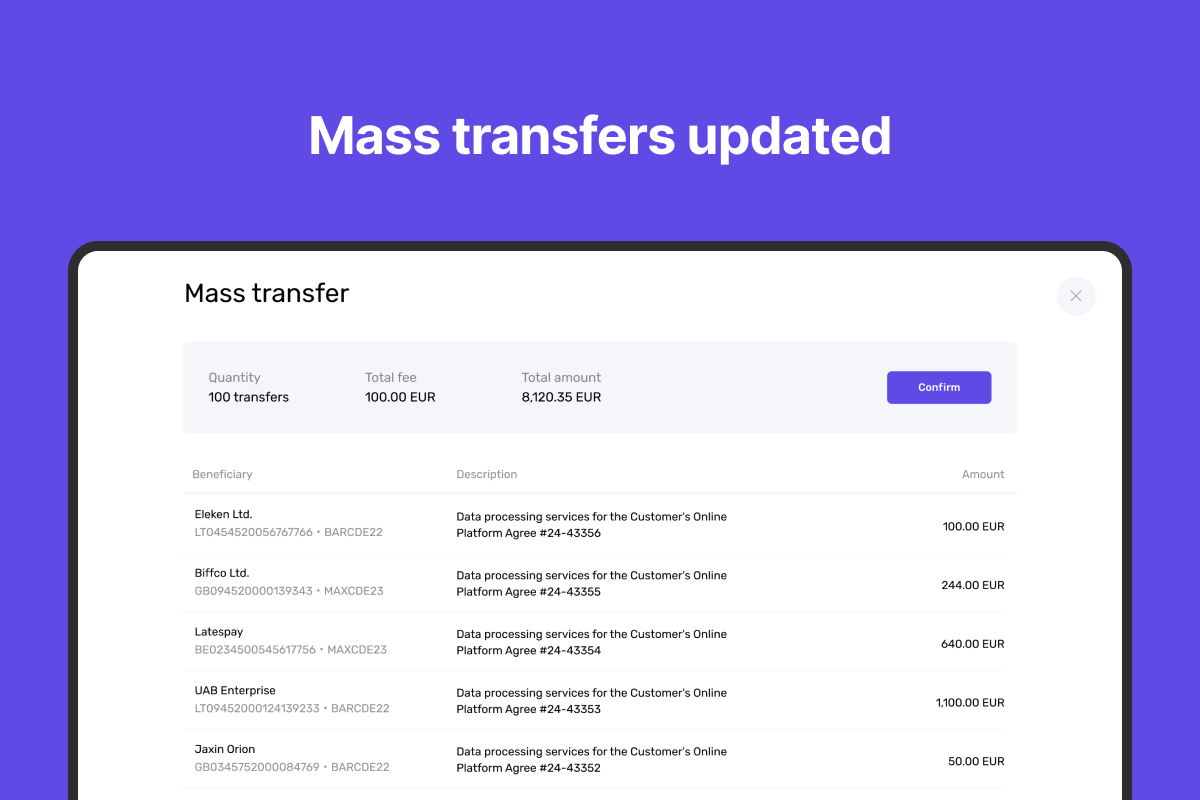

Product news

Genome improved mass transfers for business wallet users

Staying on top of your financial game is a skill every business person must acquire. Especially when it comes to mass payouts to your employees, partners, or contractors. You have to make sure you don’t overspend, don’t miss anyone, and don’t miscalculate on the transfers’ delivery time. Well, no one said you have to face all this alone – Genome is here for you! Recently we have perfected our batch transfer (aka mass transfer) feature to make it more flexible and accessible to our corporate clients. To make mass payouts, you can either use SEPA or Genome instant transfers to