Money and you

Samsung Wallet vs. Google Pay: which is right for you?

Money and you

How to use Google Pay: a step-by-step guide for 2025

Money and you

Best debit card for travel: what you need to know

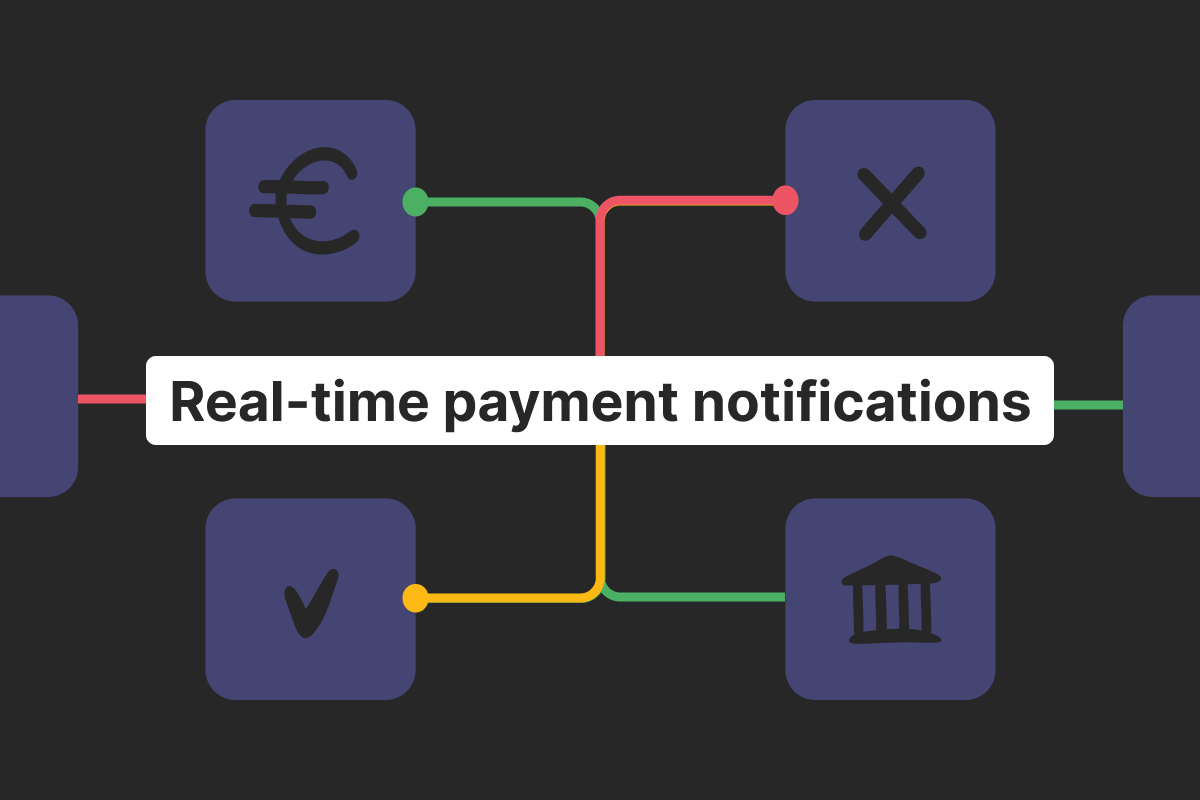

Product news

Real-time payment notifications for businesses: know about client transfers instantly!

Money and you

Currencies in Europe: what you need to know

Europe is not all about euros! After all, countries maintain their own currencies, each with unique value and history. And sometimes, especially when you travel across Europe, knowing more about those currencies and having a way of quickly using them can save you a great deal of headaches. In this article, Genome’s team will review common currencies in Europe so that you’re always aware of currency exchange options when conducting business or just visiting Europe. Why Europe has multiple currencies The abundance of different currencies within Europe shows its complex history, national identities, and economic policies. These factors greatly contributed

Money and you

Samsung Wallet vs. Google Pay: which is right for you?

Samsung Wallet and Google Pay are both useful, widely-used digital payment solutions, but which is best for you? By looking at a Samsung Wallet vs. Google Pay comparison, you can see their main elements side by side to make a more informed decision on which to use for payments. Overview of Samsung Wallet and Google Pay At first sight, the main difference is that the Samsung Pay wallet is exclusive to Samsung devices, while the Google wallet can be used on virtually any Android device. If you’re using a personal account or a start-up business account, either of these services

Money and you

How to use Google Pay: a step-by-step guide for 2025

Google Pay is fast and secure and is one of the key features for many Android-based devices. With just a few clicks, anyone can pay at stores, send funds to someone, or manage multiple transactions. So, how do you use Google Pay? Read on to find out! What is Google Pay, and why use it? Google Pay is a digital wallet and payment service developed and provided by Google that allows you to send, receive, and store funds securely. Primarily compatible with Android, it also works on iOS and web platforms with a free download. So, why is it good?

Money and you

Best debit card for travel: what you need to know

Not all debit cards are created equal when it comes to their owner traveling abroad and foreign transaction fees. And, sadly, the cards don’t always cover all countries, so you should be aware of what to expect when traveling to another country. In this article, our team will take a closer look at what can be deemed as the best debit card for travel, including fees, global acceptance, and security. Why your choice of debit card matters on the road When you’re traveling, the last thing you want is to be left without any cash in the middle of nowhere